- Who We Serve

- What We Do

- About Us

- Insights & Research

- Who We Serve

- What We Do

- About Us

- Insights & Research

Sustainable Investing

Sustainable Investing Built for Your Goals

2022 Stewardship Report

Contact Us

Northern Trust offers a range of solutions to meet the sustainable investing objectives and targeted outcome for investors globally. Offerings cover equity, fixed income and real assets, leverage our global depth & expertise in quantitative active and index investing and are available in vehicles and structures to suit the needs of institutional and individual investors.

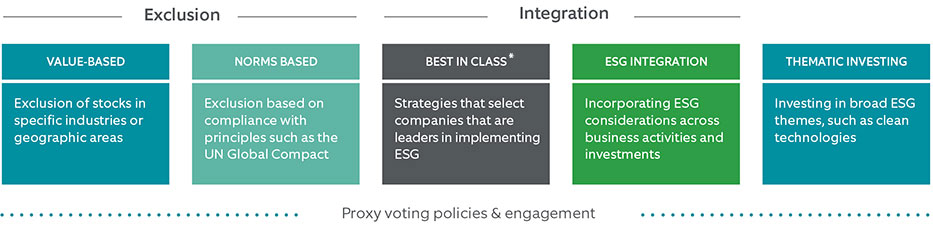

- Exclusionary Screening: Strategies that avoid investing in companies based on specific business activities, values or risk use environmental, social & corporate governance (ESG) criteria and analytics. These types of investment strategies may also incorporate a norms-based exclusion approach relative to principles from the UN Global Compact.

- Best-in-Class: Products that seek to invest in those companies that are leaders in implementing ESG or Sustainable Investing principles and avoid those companies who may be lagging in this area.

- ESG Integration: Strategies that incorporate ESG considerations across business activities and investments to target companies exhibiting both financial and non-financial sustainability; eliminating exposure to companies involved in objectionable business lines, and avoiding exposure to the least financially sustainable companies.

- Proxy Voting and Engagement: We advocate for strong corporate governance practices that we believe will create and sustain long-term value for our clients. Read our Proxy Voting and Engagement policy.

*Best-in-class ESG is industry

terminology referring to an investment approach that selects companies that are leaders

in implementing ESG.

QUANTITATIVE STRATEGIES

A sustainably designed quantitative approach to investing at the intersection of high-quality and highly rated ESG companies.