- Who We Serve

- What We Do

- About Us

- Insights & Research

- Who We Serve

- What We Do

- About Us

- Insights & Research

U.S. Treasuries Falling Out Of Favor?

Trade tensions are adding to volatility in bond markets.

By Vaibhav Tandon

My father always reminds me that there’s no such thing as a free lunch in life. We must now apply that lesson to investments and question whether anything is truly risk-free.

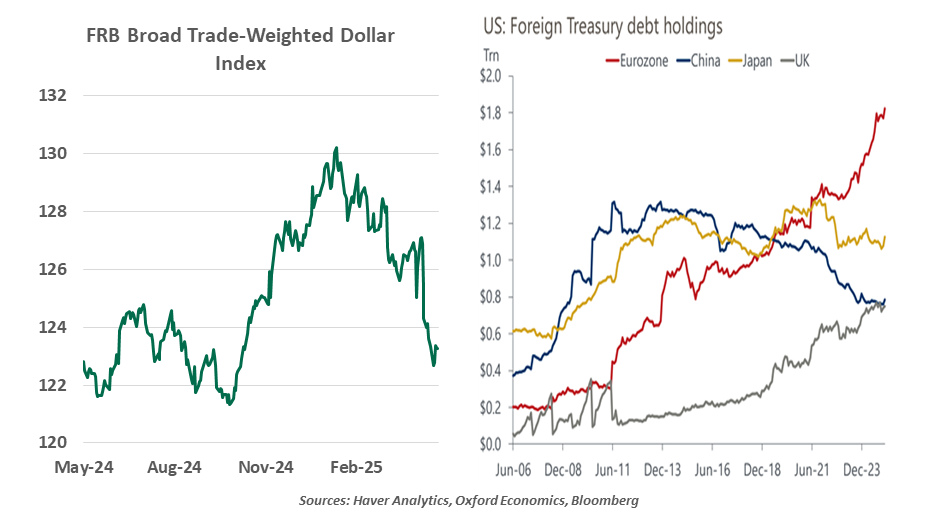

For decades, U.S. Treasuries have been universally regarded as a benchmark and a safe haven asset during periods of turmoil. But of late, U.S government bonds are being traded as a more risky asset. Instead of taking refuge in Treasuries amid equity market volatility, investors have been looking elsewhere. Within days of the U.S. tariff announcement on April 2, the dollar’s value and bond prices tumbled, pushing the yield on the 10-year Treasury up by 50 basis points.

Inflation risks and the uncertainty over the impact of trade policy on the U.S. economy have prompted investors to demand higher returns on bonds. An unwinding of large leveraged bets on Treasury prices amplified the correction.

A broader shift away from dollar assets has also played its part. Policy flip-flops eroded confidence in the U.S. dollar, leading investors to favor emerging market, Japanese and European bonds. Since April 2, emerging market local currency bonds have recorded an inflow of $2.4 billion, up from $500 million in March. A weaker dollar will make imports and commodities more expensive, fueling inflation and potentially keeping the Fed on hold for a while.

Foreign central banks have been unloading their Treasury holdings for quite some time.

The relatively sharp sell-off also gave rise to conjecture that foreign central banks were selling their Treasury holdings as retribution for America’s war on global trade. However, the evidence for this is thin. Japan and China are the two largest holders of American government bonds and have been reducing their holdings for quite some time. China’s official Treasury holdings have shrunk by almost half to under $800 billion over the past decade, with a focus on maintaining currency stability. Japanese investors were sellers of foreign debt in the first two weeks of April, but they increased their holdings again thereafter.

If the two holders were aggressively trimming their U.S. government debt allocation, markets would have probably endured far greater turmoil. Dumping Treasuries would have hurt the two Asian economies as much as it would hurt the United States: they would be selling bonds at a loss and driving down the value of their foreign reserves. We will stay tuned to Treasury auction activity to see whether foreign holders are steering any new investments away from U.S. debt.

Though the sell-off in Treasurys has eased amid increasing hints of tariff relief, daily volatility in the bond market has remained elevated. Lasting calm will only return when deals come together to avert a full-blown trade war. But as we adapt to a more tense global market, regarding Treasuries as a free lunch may prove to be quite an expensive meal.

Related Articles

Read Past Articles

Meet Our Team

Carl R. Tannenbaum

Chief Economist

Ryan James Boyle

Chief U.S. Economist

Vaibhav Tandon

Chief International Economist

Subscribe to Publications on Economic Trends & Insights

Gain insight into economic developments and our latest forecasts for the United States.

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2025 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/terms-and-conditions.