- Who We Serve

- What We Do

- About Us

- Insights & Research

- Who We Serve

- What We Do

- About Us

- Insights & Research

Efficient liquidity solutions designed to deliver value in every market cycle

Northern Trust Asset Management Launches US Dollar Treasury Strategy

Custom strategies built to help you manage cash along the spectrum of liquidity needs.

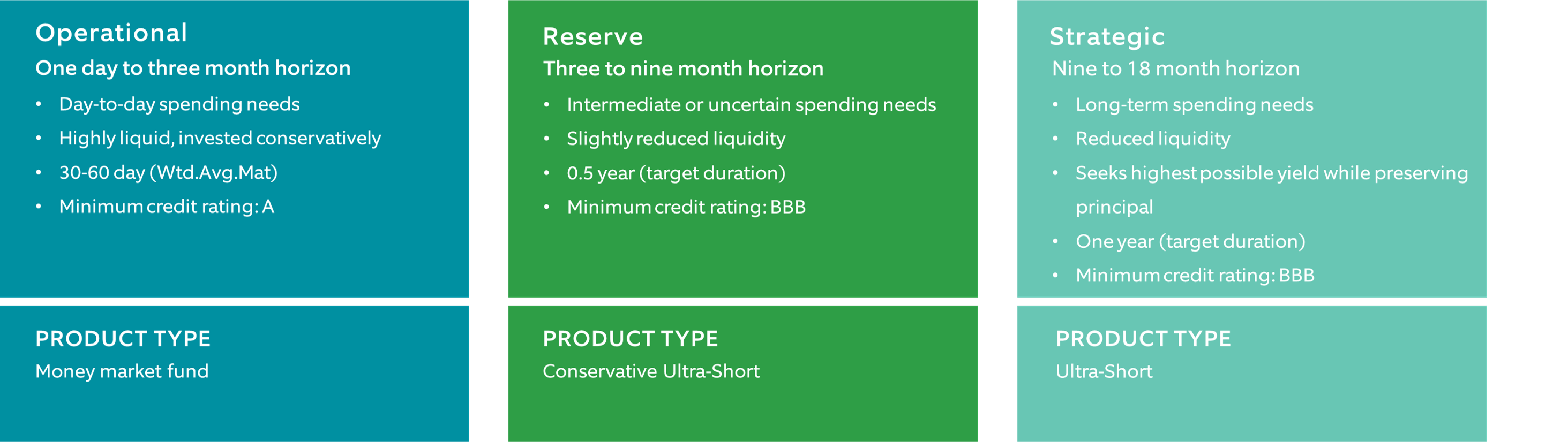

When it comes to your cash, one size simply does not fit all. Understanding how to categorize your cash to align with your risk, return and liquidity needs and expectations can drive an effective investment strategy.

Northern Trust liquidity strategies manage cash along the liquidity spectrum of investor needs — from operational to reserve to longer-term, strategic uses of cash. Our deep global expertise in rates, credit and risk management — together with our global scale — can help clients navigate changing economic landscapes.

Conservative Investment Principles

- Capital Preservation – comprehensive risk controls, a consistent and robust investment approach, and an extensive credit review process are fundamental to our investment strategy.

- Liquidity Management – the size and scale of Northern Trust Global Investments allows for comprehensive liquidity management.

- Competitive Yield - seeks maximum current income while preserving capital and liquidity.

Fund Ranges and Tailored Solutions

- Government liquidity funds – designed for investors with a short-term investment horizon seeking the security of exposure only to highly rated governments. These funds are targeted to provide you with returns consistent with short-term government interest rates whilst maintaining a high level of liquidity.

- Money Market funds – developed as a solution for investors who have a short-term investment horizon and uncertain liquidity requirements. Available in USD, EUR and GBP the funds provide capital preservation, daily liquidity and a return commensurate with the underlying market.

- Ultra-Short funds – for investors interested in maximizing income while maintaining reasonable liquidity, our ultra-short strategies invest in high quality, liquid investments with durations ranging from overnight to five years.

- Tailored solutions – created hand-in-hand with you, to respond to your individual investment requirements or longer-term cash objectives.

An Effective Strategy for Any Liquidity Profile

With maturities from one day to 18 months, our solutions seek to maximize returns across the liquidity spectrum.

IMPORTANT INFORMATION

FOR INSTITUTIONAL/ WHOLESALE /PROFESSIONAL CLIENTS AND QUALIFIED INVESTORS ONLY — NOT FOR RETAIL USE OR DISTRIBUTION

This information is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

All securities investing and trading activities risk the loss of capital. Each portfolio is subject to substantial risks including market risks, strategy risks, advisor risk, and risks with respect to its investment in other structures. There can be no assurance that any portfolio investment objectives will be achieved, or that any investment will achieve profits or avoid incurring substantial losses. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Risk controls and models do not promise any level of performance or guarantee against loss of principal. Any discussion of risk management is intended to describe NTAM’s efforts to monitor and manage risk but does not imply low risk.

Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For more information, read our legal and regulatory information about individual market offices.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K., NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Northern Trust Asset Management Australia Pty Ltd, and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.