- Who We Serve

- What We Do

- About Us

- Insights & Research

- Who We Serve

- What We Do

- About Us

- Insights & Research

Scarcity, Security, and the Search for Real Return

Gold, digital gold (blockchain-backed gold), and critical minerals are drawing interest as money supply grows and certain resources become scarcer.

KEY POINTS

What it is

We explore how growth in the money supply and how limited availability of certain assets could influence investor thinking about real returns.

Why it matters

Investors face new hurdles as money supply grows and asset scarcity rises — gold, digital gold, and critical minerals are among the assets receiving attention in current market conversations.

Where it's going

Developments in digital gold and increased attention to critical minerals may shape future conversations about portfolio construction, though risks and uncertainties remain

The Weekender is my bi-weekly take on macro shifts and emerging themes. It’s not investment advice — or even our firm’s official view. I aim simply to inform, challenge, and maybe entertain. If you’d like this in your inbox every other Saturday morning via Northern Trust, subscribe to The Weekender.

Higher Hurdles

Many investors target consumer price index (CPI)-plus returns to preserve purchasing power and, ideally, generate real returns over time. CPI helps offset inflation’s corrosive effects, but does it account for monetary debasement? That remains unclear.

It’s not just central banks expanding the money supply — private banks do too. Every loan issued creates new money by crediting the borrower’s account, increasing the amount of money in circulation. M2, which captures this, just hit a record $22 trillion (with Federal Reserve cuts looming). It was $6.9 trillion two decades ago. That implies U.S. dollar purchasing power has eroded at a compounded rate of nearly 6% per year. While not a formal benchmark, might some investors start using M2 growth as a conceptual lens for evaluating real returns? And if so, might the hurdle rate for real returns increase to reflect this? M2 growth + X% perhaps?

Real Returns

Let’s park this question for now (and the question of whether markets are cheaper once adjusted for M2 growth). Instead, let’s identify assets with constrained or declining supply, or where supply cannot keep pace with the growth of the money supply.

Three stand out:

- U.S. large-cap equities, where annual buybacks have lowered the float.

- Bitcoin, with its fixed 21 million supply.

- Gold, with supply growth of roughly 1% vs. a 30% surge in money supply since the COVID-19 epidemic.

Gold

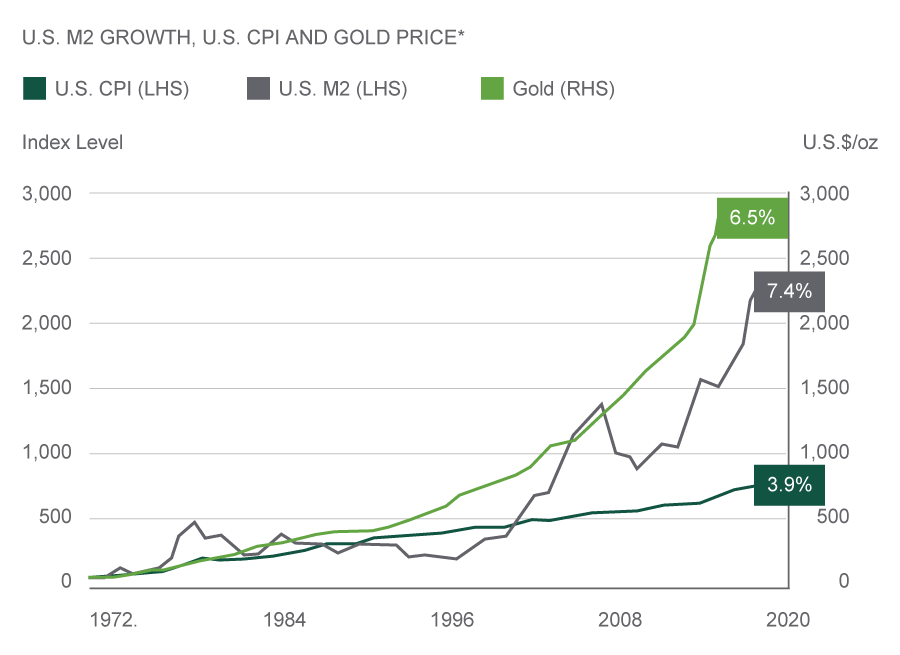

Northern Trust has published thoughtful research analyzing 150 years of inflation data, showing gold — and quality factors — can persist through both inflationary and deflationary extremes (see here1). More compelling is research2 from the World Gold Council (WGC), which argues that while CPI-linked instruments like Treasury Inflation-Protected Securities (TIPS) protect future spending, only gold has historicallyshielded purchasing power from surging money supply. The chart from another WGC report,3 illustrates this well (Exhibit 1).

EXHIBIT 1: GOLD PRICES

Gold prices have tracked the expansion of the U.S. money supply.

*As of Dec. 31, 2024, U.S. CPI and U.S. M2 were constructed using data from Jan. 1972 and re-based to 100 on Jan. 1972. Gold based on the LBMA Gold Price PM USD.

Source: Bloomberg, ICE Benchmark Administration, World Gold Council.

A Digital Reincarnation: Digital Gold

But what’s really exciting is the Financial Time’s piece: "London’s Bullion Market to Trial Digital Gold4." I’ve been intrigued by this concept since it first surfaced. Wrote about it here5 and interviewed WGC CEO David Tait here.6

David’s vision? A blockchain-based registry of responsibly sourced gold, tokenised for digital use. The goal: better governance, provenance, environmental impact, and system collateral. It’s a fintech play with real-world utility — one that could appeal across the investor spectrum, from retail to institutional, Gen Z to pension funds.

So What?

Gold has long been about preservation, not appreciation. A defensive asset; a hedge against inflation, financial repression, and currency debasement. When trust in the system falters — like it did in the 1970s and again after the seizure of Russian reserves — central banks accumulate. Gold now makes up just over 20% of foreign reserves, albeit far below 1970s levels.

The WGC wants to rewrite the narrative — to connect gold’s defensive past to a more offensive future. It’s ambitious, unfinished, but potentially transformative. Millions of new investors could be drawn to digital gold for the same reasons they were captivated by crypto. If you’re curious, and have 20 minutes, listen to this: MoneyMaze podcast.7 David’s story is worth it.

Copper Bottomed

In a Cabinet meeting on Aug. 26,8 U.S. President Donald Trump acknowledged the U.S. may be winning the artificial intelligence (AI) capital expenditure race, but is losing the AI electricity race:

President Trump’s statement:

"We would need double the energy. If you take all the electricity that we produce right now in this country, you'd have to multiply it times two or maybe three times. So three times more than we have right now for everything to operate your toaster and everything else. Okay? Three times more.”

Rio Tinto, a British-Australian multinational company and one of the world’s largest metals and mining corporations, noted on it’s second-quarter earnings call that electricity demand is growing 2.5 times faster than overall energy demand. We’ve previously discussed silver9 demand from Chinese solar and U.S. military applications. Copper demand is rising from energy reindustrialisation. Both metals now appear in the draft 2025 Critical Minerals List — essential for U.S. national security.

Translation: a new buyer may emerge. Strategic, price-insensitive, and large. That buyer could provide a copper-bottom for the industry.

Buying Local – Continued

As noted10 last time, one argument for developed market ex-U.S. equities is low retail participation — a potential source of marginal liquidity if governments succeed in nudging savers into markets. In the E.U., Bloomberg11 suggests that if German equity ownership matched France’s (as a percentage of gross domestic product), it could unlock €1.1 trillion — nearly half the size of the entire German market (€2.6 trillion).

In China, regulators are trying to cool a $1.2 trillion stock rally to promote long-term, stable investing and reduce speculation. This shift supports economic recovery and helps address demographic pressures, as fewer workers will be supporting more retirees. Stronger, more sustainable, and less volatile capital markets could ease strain on the social safety net and replicate the U.S. model of retirement wealth, where retirees rely more on retirement income than state pensions. While it’s unlikely China will reach U.S. levels anytime soon, as Exhibit 2 below shows, it has a long way to catch up — a fact likely not lost on the Chinese Communist Party (CCP).

EXHIBIT 2: AMERICAN EXCEPTIONALISM

The Cruellest Irony

It would be a cruel irony if climate change delays the U.K.’s net-zero ambitions. The U.K. has limited North Sea oil and gas investment in favor of renewables, relying heavily on Norwegian imports. But Norway’s hydro lakes are low — thanks to scant snowfall and a hot summer. With hydro making up roughly 90% of Norway’s electricity, prices may surge.

In a worst-case scenario, Norway could become a net importer12 pushing U.K. electricity prices higher — at the worst possible time. Long-term gilts, which are U.K. government bonds, may already be reflecting these pressures. If fiscal pressures mount, net-zero spending could come under scrutiny — and Norway’s role too. Curiously, North Sea exploration stocks are rising, even as oil prices fall. Do they know something we don’t?

1 Guido Baltussen, Milan Vidojevic, and Bart Van Vliet. “Navigating Inflation and Tariffs: Strategic Lessons from 150 Years of Data.” Northern Trust Asset Management, 2025.

2 World Gold Council. “Beyond CPI: Gold as a Strategic Inflation Hedge.” Goldhub Research, April 21, 2021.

3 World Gold Council. “Gold as a Strategic Asset: 2025 Edition.” Goldhub Research, January 23, 2025.

4 Joe Miller, Myles McCormick, and James Politi. “Donald Trump’s Tariffs Ruled Illegal by US Appeals Court but Stay in Place.” Financial Times, August 29, 2025.

5 Gary Paulin. “A Golden Opportunity, Defining Bravery and Bad Australian Humour.” LinkedIn Pulse, April 15, 2024.

6 Grant Johnsey and Jody Gunderson. “What’s Driving the Boom in Asset-Based Finance?” Faster Forward – A Northern Trust Podcast, August 13, 2025.

7 Money Maze Podcast. “Gold! Why & How to Own It, Tokenisation and Investor Positioning – With David Tait.” YouTube, August 16, 2024.

8 Donald Trump. “Trump Cabinet Meeting Transcript – August 26, 2025.” Rev.com, August 26, 2025.

9 Gary Paulin. “New Narratives Needed.” The Weekender – Northern Trust Asset Management, August 22, 2025.

10 Paulin, “New Narratives Needed.”

11 Jana Randow and Nicholas Comfort. “Cash-loving Germans are Finally Joining the Stock Market Frenzy.” Bloomberg, August 22, 2025. Kathryn Porter. “Norway’s Electricity Crisis Is About to Hit Britain.” The Telegraph, August 31, 2025.

12 Kathryn Porter. “Norway’s Electricity Crisis Is About to Hit Britain.” The Telegraph, August 31, 2025.

Meet Your Expert

Gary Paulin

Chief Investment Strategist, International

Gary Paulin is chief investment strategist, international for Northern Trust Asset Management. He is responsible for developing and communicating the firm’s investment outlook across asset classes as well as producing investment analysis and thought leadership for the broader marketplace globally. To build out economic and market views, Gary regularly collaborates with the firm’s investment teams in equities, fixed income, multi-asset and alternatives.

Consumer Price Index (CPI): A measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care.

Critical Minerals List: A list published by the U.S. government identifying minerals essential to national security and economic prosperity.

M2: A broad measure of the money supply that includes cash, checking deposits, savings accounts, money market funds, and certificates of deposit.

Treasury Inflation-Protected Securities (TIPS): U.S. government bonds designed to help protect investors from inflation, with principal and interest payments adjusted by changes in the CPI.

IMPORTANT INFORMATION

Northern Trust Asset Management is composed of Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K., NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Northern Trust Asset Management Australia Pty Ltd, and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

Issued in the United Kingdom by Northern Trust Global Investments Limited, issued in the European Economic Association (“EEA”) by Northern Trust Fund Managers (Ireland) Limited, issued in Australia by Northern Trust Asset Management (Australia) Limited (ACN 648 476 019) which holds an Australian Financial Services Licence (License Number: 529895) and is regulated by the Australian Securities and Investments Commission (ASIC), and issued in Hong Kong by The Northern Trust Company of Hong Kong Limited which is regulated by the Hong Kong Securities and Futures Commission.

For Asia-Pacific (APAC) and Europe, Middle East and Africa (EMEA) markets, this information is directed to institutional, professional and wholesale clients or investors only and should not be relied upon by retail clients or investors. This information may not be edited, altered, revised, paraphrased, or otherwise modified without the prior written permission of NTAM. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. NTAM may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, its accuracy and completeness are not guaranteed, and is subject to change. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor.

This information is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

All securities investing and trading activities risk the loss of capital. Each portfolio is subject to substantial risks including market risks, strategy risks, advisor risk, and risks with respect to its investment in other structures. There can be no assurance that any portfolio investment objectives will be achieved, or that any investment will achieve profits or avoid incurring substantial losses. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Risk controls and models do not promise any level of performance or guarantee against loss of principal. Any discussion of risk management is intended to describe NTAM’s efforts to monitor and manage risk but does not imply low risk.

Past performance is not a guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by NTAM. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index. Net performance returns are reduced by investment management fees and other expenses relating to the management of the account. Gross performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise. For U.S. NTI prospects or clients, please refer to Part 2a of the Form ADV or consult an NTI representative for additional information on fees.

Forward-looking statements and assumptions are NTAM’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information.

Not FDIC insured | May lose value | No bank guarantee