- Who We Serve

- What We Do

- About Us

- Insights & Research

- Who We Serve

- What We Do

- About Us

- Insights & Research

America's Rescue Plan for Argentina

Argentina's latest lifeline does not address the nation's structural issues.

By Vaibhav Tandon

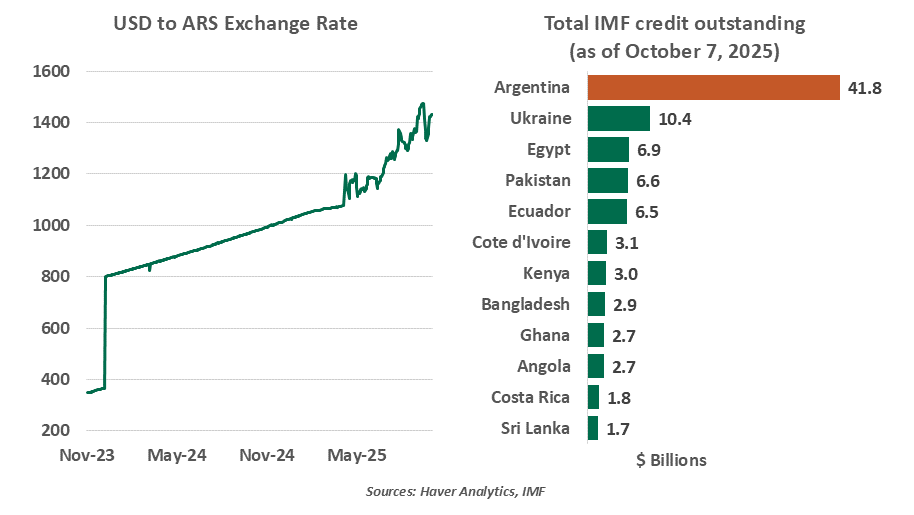

Argentina has long been a poster child of economic instability. Recurring cycles of debt defaults, hyperinflation, balance of payment crises and abrupt policy shifts have steadily eroded investor confidence. Over time, economic turmoil has become less an exception and more a baseline feature of the country’s macroeconomic landscape.

Argentine President Javier Milei’s radical reform agenda was starting to yield some positive results. His aggressive fiscal tightening delivered a rare budget surplus and helped curb inflation. Yet the country once again finds itself on the brink.

Investor confidence has been rattled by mounting political uncertainty ahead of the October 26 midterm elections, as Milei has faced a string of domestic setbacks. These include allegations of corruption and a weak showing for his party in provincial elections. But the most consequential blow came when the Argentinian Congress overturned key elements of the government’s fiscal consolidation plan. This reversal not only threatens to push the budget back into deficit next year but also risks derailing Argentina’s support from the International Monetary Fund (IMF).

These developments rattled markets, triggering a sharp sell-off in the Argentine peso. The central bank stepped in to defend the currency, but its already depleted international reserves could not turn the tide. Fortunately for Mr. Milei, support came from an unexpected quarter: the Trump administration extended a $20 billion lifeline to Argentina. The extraordinary move has, for now, calmed market nerves and helped stabilize the peso.

The U.S. rescue package will fall short of stabilizing Argentina’s economy.

Although U.S. support has secured Argentina’s bond payments through 2026, it does little to address the country’s financial problems. Mounting job losses and weak consumer spending have raised fears of a recession. Nearly one-third of Argentines live in poverty. The central bank has struggled to rebuild reserves, leaving it vulnerable during episodes of market panic. While Argentina has several options to boost its U.S. dollar reserves, each comes with trade-offs. Slashing the value of its currency could attract more dollars, but it would come at the cost of higher inflation and political backlash. Given its long history of debt restructurings, skepticism around Argentina’s repayment capacity is far from misplaced.

The U.S. intervention is not a direct cash injection, but rather a liquidity backstop via the Exchange Stabilization Fund (ESF). The U.S. Treasury finalized a $20 billion currency swap framework with Argentina’s central bank and bought pesos in the open market on Thursday. However, the lack of clarity around the terms has raised questions about the conditions attached, fueling concerns over legal oversight and transparency.

While the ESF gives the U.S. Treasury flexibility to act without congressional approval in emergencies, longer-term or larger-scale commitments may still require legislative backing. Republican lawmakers have voiced opposition, citing concerns over taxpayer exposure.

U.S. intervention in this form is not without precedent. The use of the ESF and swap lines dates back to the 1995 Mexican peso crisis, when the U.S. extended a similar lifeline to its Southern neighbor. The amount was ultimately repaid with interest and viewed as a successful stabilization effort. However, Argentina’s structural weaknesses make this case far riskier. The country has defaulted on its sovereign debt nine times and remains the IMF’s largest debtor, still owing over $40 billion from its 2018 bailout.

The U.S. may not be purely driven by economic altruism. Many observers view the aid to the ideologically-aligned Argentine administration as a strategic move to counter China’s growing influence in the region. Washington is reportedly pressuring Argentina to cancel its $18.5 billion currency swap line with China, and to increase mining of rare earth minerals. The U.S. may also see a stable Argentina as a buffer against further migration flows, particularly in light of the ongoing Venezuelan refugee crisis.

America’s helping hand simply postpones the next crisis and does not mark a turning point. Without meaningful reform, that reality is unlikely to change.

Related Articles

Read Past Articles

Meet Our Team

Subscribe to Publications on Economic Trends & Insights

Gain insight into economic developments and our latest forecasts for the United States.

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2025 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/terms-and-conditions.