- Who We Serve

- What We Do

- About Us

- Insights & Research

- Who We Serve

- What We Do

- About Us

- Insights & Research

Weekly Economic Commentary | January 9, 2026

Auto Loans Show Consumer Strains

High prices and high interest rates presaged higher defaults.

By Ryan Boyle

In the pandemic, my home office was decorated with a banana plant. We knew the lockdown had gone on too long when the plant grew so tall that it stretched beyond the frame on my video calls.

Pressures on household balance sheets have grown in a similar manner: quietly but persistently, liabilities are reaching levels that are challenging some households. Inflation has diminished the real incomes that are necessary to sustain debt service. As a result, we are seeing higher defaults on consumer credit, particularly auto loans.

Lenders understand that not all loans will be repaid. Their task is to set the right size and price for loans that makes them affordable to the borrower while providing compensation for risk. For many years, assessing consumer credit risk had been routine and reliable: Credit score models summarized the behavior in credit files numerically. The scores informed consumers' loan eligibility.

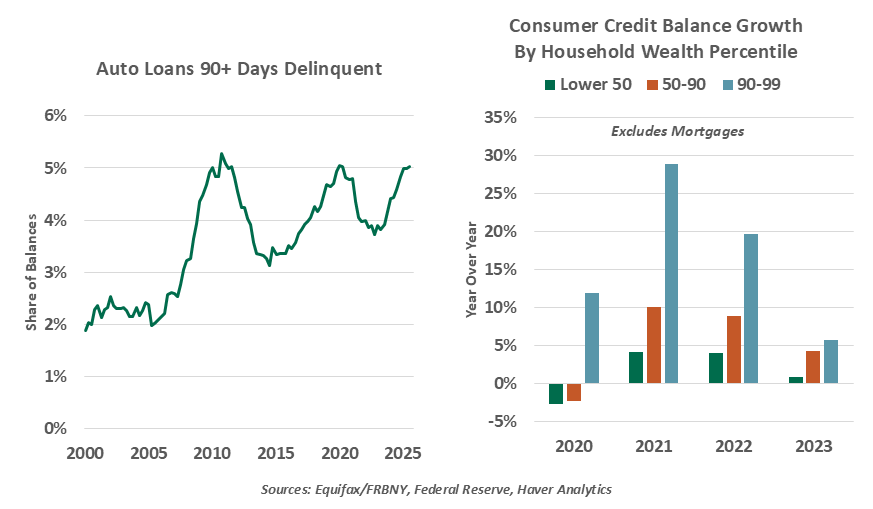

Of late, though, credit performance has been worse than the expected probability of default. Stress has become more common among all consumer strata. In particular, auto loan delinquency rates have approached levels last seen in the Global Financial Crisis (GFC).

Credit scores are calculated only using a consumer’s liabilities, not income or assets. However, income and credit scores are correlated: in case of a financial shock, those with greater incomes will tend to have more cushion to make payments. Surprisingly, though, delinquency data shows that consumers with higher ratings are feeling more stretched.

Some car buyers took on larger loans than they could manage.

This is inflation in action. Every consumer’s nominal expenditures have risen. We worry first about lower-income consumers bearing the brunt of inflation as the cost of essential purchases goes up. But higher earners were not immune to cost pressures, as they sought to sustain pricier lifestyles which included premium vehicles. Housing costs have been rising much faster than the general rate of inflation, taking a bigger bite out of household budgets.

The Bureau of Labor Statistics estimates that new vehicle prices surged over 21% from 2020 to 2023, a faster rate than the gain seen hot categories like healthcare. The cost of financing those vehicles also climbed as short-term interest rates rose starting in 2022. These costs are more likely to be spread across a longer term to produce a monthly payment that may seem within the buyer’s budget. Credit bureau TransUnion reports an average new vehicle payment weighs in at $760 per month, for an average term just shy of six years.

But principal and interest are only a subset of vehicles’ cost. Since 2020, maintenance and insurance costs have risen by 48% and 56% respectively. Lower gas prices offer only a brief respite from the structurally higher total cost of ownership.

Defaults among auto loans are noteworthy because these had been seen as a safe form of lending. Living without a car is impossible in much of the United States; in the GFC, borrowers were more likely to surrender their home than their car. Consequences of default are rapid: Repossession happens within months of a missed payment. Stretched loan terms are leaving more borrowers with no equity, preventing a sale that could prevent a visit from a tow truck.

Though wages are still rising, more affordability challenges are likely in store in the near term. Potentially 19 million borrowers who have defaulted on their student loans may face wage garnishment or have their income tax refunds withheld. Interest rates are unlikely to fall significantly. The full costs of tariffs have not yet been felt.

An old financial proverb warns us that interest on debt grows without rain. As costs of living continue to grow, more borrowers will struggle to stay dry; sadly, their cars may no longer be available to take refuge.

Related Articles

Read Past Articles

Meet Our Team

Carl R. Tannenbaum

Chief Economist

Ryan James Boyle

Chief U.S. Economist

Vaibhav Tandon

Chief International Economist

Subscribe to Publications on Economic Trends & Insights

Gain insight into economic developments and our latest forecasts for the United States.

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2025 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/terms-and-conditions.