- Who We Serve

- What We Do

- About Us

- Insights & Research

- Who We Serve

- What We Do

- About Us

- Insights & Research

Insights & Research

Give your goals momentum with our latest insights.

The Northern Trust Institute

The Northern Trust Institute couples our long history of working with wealthy families

with disciplined research to bring you impactful strategies for managing wealth.

Our Experts

Pete is an executive vice president and the bank's chief operating officer, a role he assumed in October 2024.

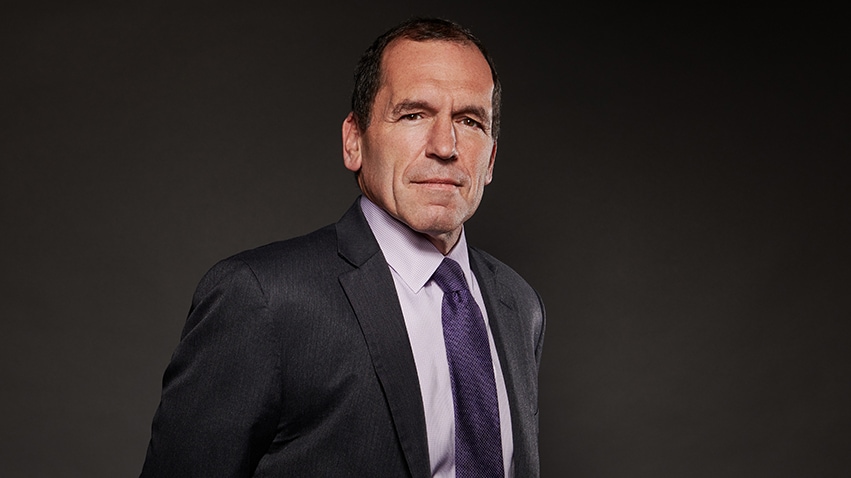

Carl Tannenbaum is the Chief Economist for Northern Trust. In this role, he briefs clients and colleagues on the economy and business conditions, prepares the bank's official economic outlook and participates in forecast surveys. He is a member of Northern Trust's investment policy committee, its capital committee, and its asset/liability management committee.

Katherine Nixon is an Executive Vice President and President of the Northeast Region, Wealth Management.

More Insights & Research

The proactive, holistic guidance we provide clients is supported by the deep expertise

of our thought leaders. Access up-to-date global analysis and market insights from

our experts.